With the end of the year just around the corner, now is an excellent time for you to review your charitable contribution. You might want to make a list to ensure that you have taken full advantage of all of the tax saving deductions available to you. Here are some ideas for year-end planning that can help support our cause and benefit you.

With the end of the year just around the corner, now is an excellent time for you to review your charitable contribution. You might want to make a list to ensure that you have taken full advantage of all of the tax saving deductions available to you. Here are some ideas for year-end planning that can help support our cause and benefit you.

CHARITABLE CONTRIBUTIONS

A simple gift of cash or an unneeded asset can assist our work and provide you with valuable tax savings.

CHARITABLE GIFT ANNUITY

Double your benefits while making a gift and receiving cash back. A gift annuity gives you income tax advantages this year while providing you with dependable payments for life at fixed rates as high as 9.5%.

IRA CHARITABLE ROLLOVER

If Congress again passes the IRA charitable rollover. You can transfer up to $100,000 directly from your IRA to a qualified nonprofit without paying federal income tax.

ADDITIONAL TAX SAVINGS

Be sure to review your mortgage, medical, education, business and other miscellaneous expenses to determine if there are additional ways you can save on taxes this year. Check your list against your advisor’s recommendations to avoid missing any significant deductions. Congress has changed the rules in recent years. If you haven’t visited your attorney to review your estate plan, you should make an appointment before the end of the year or early in the new year. Your plans may need to be updated, particularly if you have experienced life changes. Please contact us for help. We can refer you to qualified attorneys and advisors and provide you with a free guide to make your planning easier.

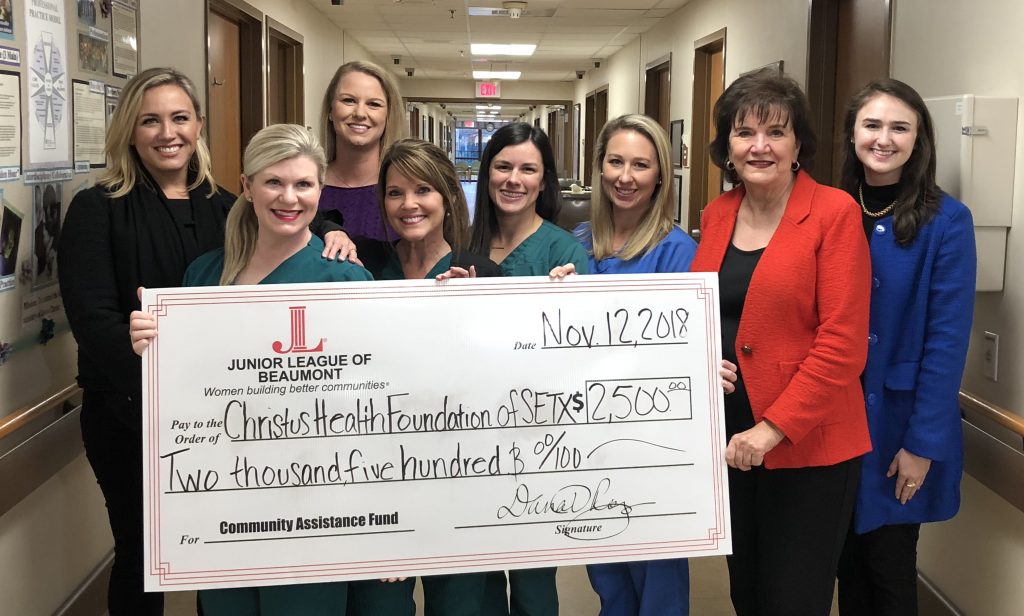

“Your gifts underwrite the work of the CHRISTUS Southeast Texas Foundation which provides vital equipment and programs for our hospitals. Thank you for your support of our mission to extend the healing ministries of Jesus Christ.” -Ivy Pate, President

View in Foundation Newsletter

Held at the Beaumont Country Club, this year’s Golden Pass LNG Swinging for a Miracle Golf Tournament was a hole in one, with businesses and organizations from all over the community coming together to golf for two great causes: Children’s Miracle Network Hospitals and the CHRISTUS Southeast Texas Foundation.

Held at the Beaumont Country Club, this year’s Golden Pass LNG Swinging for a Miracle Golf Tournament was a hole in one, with businesses and organizations from all over the community coming together to golf for two great causes: Children’s Miracle Network Hospitals and the CHRISTUS Southeast Texas Foundation. Congratulations to our winners!

Congratulations to our winners!

Walmart associates in West Orange rolled up their sleeves and participated in Fundraising Friday. Each Friday, they hosted a different fundraiser for CMN Hospitals. One day, they took turns selling popcorn to associates and customers. Another day, they cooked up savory links and served them in the break room with ice cold drinks for a $5 donation. Associates were thrilled to participate knowing their hot meal helped kids at CHRISTUS Southeast Texas St. Elizabeth and Jasper Memorial.

Walmart associates in West Orange rolled up their sleeves and participated in Fundraising Friday. Each Friday, they hosted a different fundraiser for CMN Hospitals. One day, they took turns selling popcorn to associates and customers. Another day, they cooked up savory links and served them in the break room with ice cold drinks for a $5 donation. Associates were thrilled to participate knowing their hot meal helped kids at CHRISTUS Southeast Texas St. Elizabeth and Jasper Memorial.

Bridge City associates got creative by making a wishing well at the front of the store. They posted a sign inviting customers to “toss a coin and save a life.”

Bridge City associates got creative by making a wishing well at the front of the store. They posted a sign inviting customers to “toss a coin and save a life.” A pediatric patient at CHRISTUS Southeast Texas St. Elizabeth was feeling uncomfortable and withdrawn after receiving an NG tube in her nose to help her get better. Her stress levels were high and she was not healing as quickly as doctors expected. Thankfully, St. Elizabeth’s Certified Child Life Specialist, Ashley Bares, came to the rescue.

A pediatric patient at CHRISTUS Southeast Texas St. Elizabeth was feeling uncomfortable and withdrawn after receiving an NG tube in her nose to help her get better. Her stress levels were high and she was not healing as quickly as doctors expected. Thankfully, St. Elizabeth’s Certified Child Life Specialist, Ashley Bares, came to the rescue. The CHRISTUS Southeast Texas Foundation recently purchased a Panda Warmer for the Center for New Life, the Labor and Delivery Unit at CHRISTUS St. Elizabeth Hospital. This purchase is part of an overarching project with the goal of outfitting the Center for New Life with a total of 19 Panda Warmers (one for each of the 19 Labor and Delivery Rooms). To date, the Foundation has already raised funding for nine Panda Warmers.

The CHRISTUS Southeast Texas Foundation recently purchased a Panda Warmer for the Center for New Life, the Labor and Delivery Unit at CHRISTUS St. Elizabeth Hospital. This purchase is part of an overarching project with the goal of outfitting the Center for New Life with a total of 19 Panda Warmers (one for each of the 19 Labor and Delivery Rooms). To date, the Foundation has already raised funding for nine Panda Warmers. The CHRISTUS Southeast Texas Foundation (Foundation) is proud to announce major medical equipment additions to the Mamie McFaddin Ward Cancer Center and to the Cancer Floor at CHRISTUS St. Elizabeth Hospital. For the past several years, the Foundation has worked with local foundations and individual philanthropists to update these cancer care centers with state of the art equipment to offer the best in cancer detection and treatment.

The CHRISTUS Southeast Texas Foundation (Foundation) is proud to announce major medical equipment additions to the Mamie McFaddin Ward Cancer Center and to the Cancer Floor at CHRISTUS St. Elizabeth Hospital. For the past several years, the Foundation has worked with local foundations and individual philanthropists to update these cancer care centers with state of the art equipment to offer the best in cancer detection and treatment.